Learn More

To hear about more features or schedule an eye-opening demo, contact us today.

Consider it your one-stop shop for everything you need!

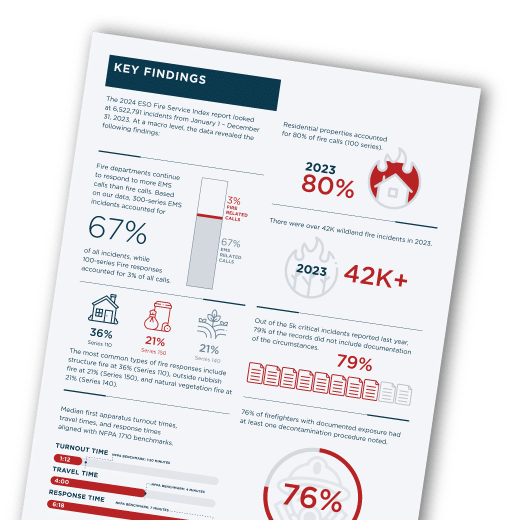

Where does your fire department stand? Are you at, below, or above these benchmarks? Find out here.

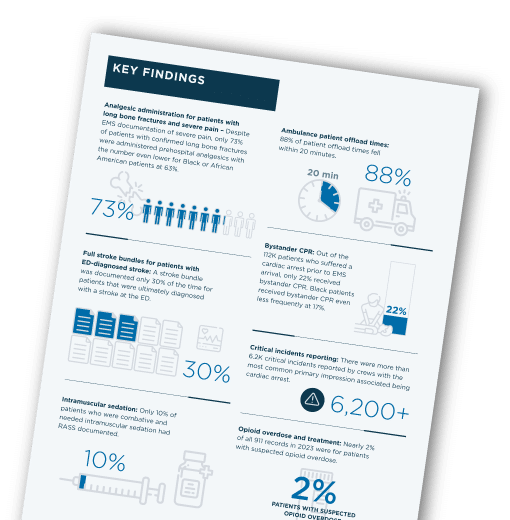

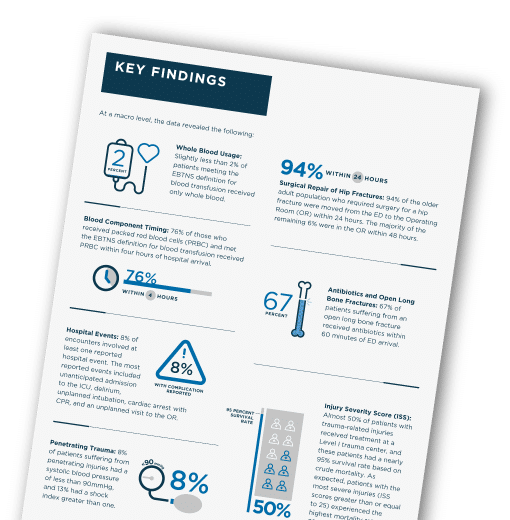

Is your organization aligned with other organizations around the country when it comes to trauma patient care? Find out here.

Prepare for the year by diving into EMS Predictions for 2023 and then taking action to get ahead of what’s coming.

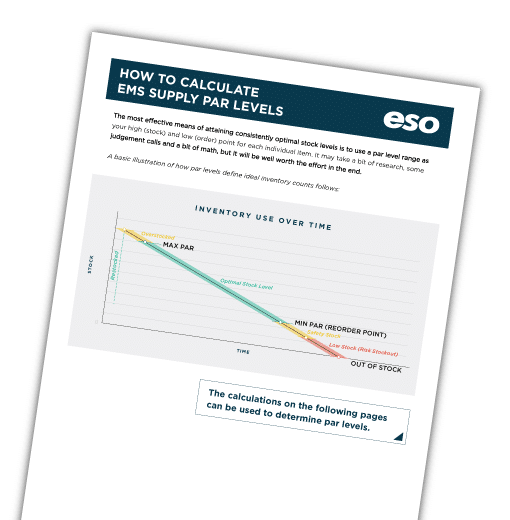

Determine exactly how much is "enough" and "too much" for your agency

To hear about more features or schedule an eye-opening demo, contact us today.